Vincit

1.78

EUR

+2.89 %

8,089 following

VINCIT

First North Finland

Software

Technology

Overview

Financials & Estimates

Investor consensus

+2.89%

-6.81%

+3.19%

+3.49%

-21.93%

-35.04%

-69.78%

-49.14%

-70.82%

Vincit provides services in design and software development. The services include, for example, software for e-commerce and web applications, cloud platforms, mobile applications and IoT solutions. The services are used by both small and medium-sized corporate customers. The main operations are in Europe and North America. Vincit was founded in 2007 and is headquartered in Finland.

Read moreMarket cap

30.18M EUR

Turnover

1.17K EUR

P/E (adj.) (25e)

13.15

EV/EBIT (adj.) (25e)

7.22

EV/S (25e)

0.25

Dividend yield-% (25e)

6.74 %

Coverage

Analyst

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

24/4

2025

Interim report Q1'25

17/7

2025

Interim report Q2'25

23/10

2025

Interim report Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

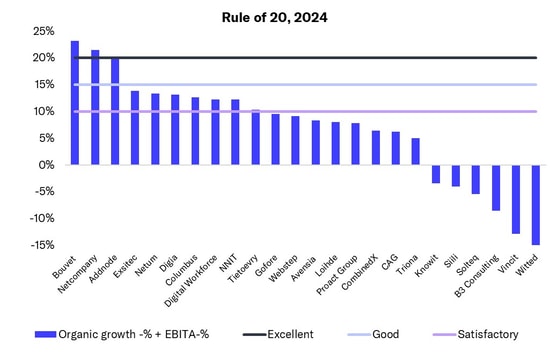

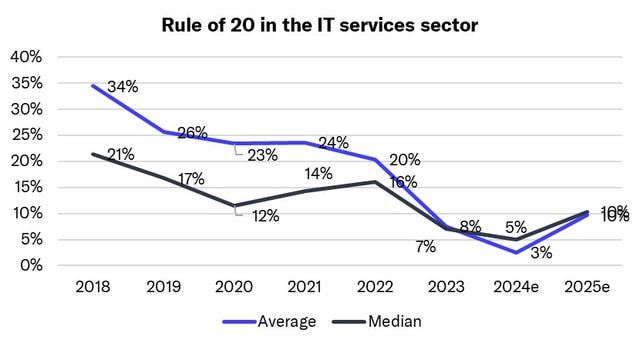

In the IT service sector, a few Nordic companies achieved excellent performance measured by the 'Rule of 20'

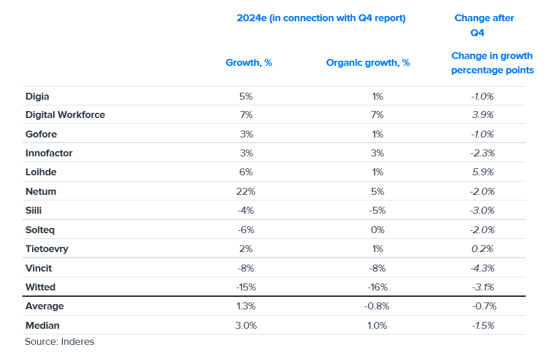

IT service sector: Q4 was tough, as was 2024

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Introducing the Rule of 20: The best measure for IT services performance signals market softening

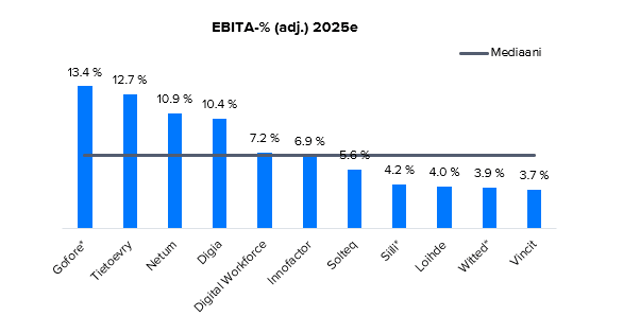

IT service sector: Bottom of cycle passed, grain will be separated from chaff in 2025

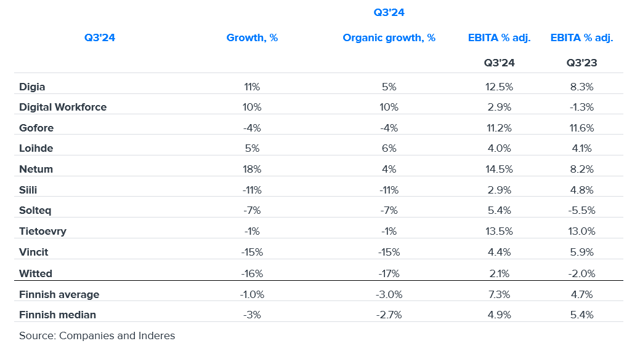

Q3 IT service sector summary: Revenue down but profitability up – sector shows clear divide

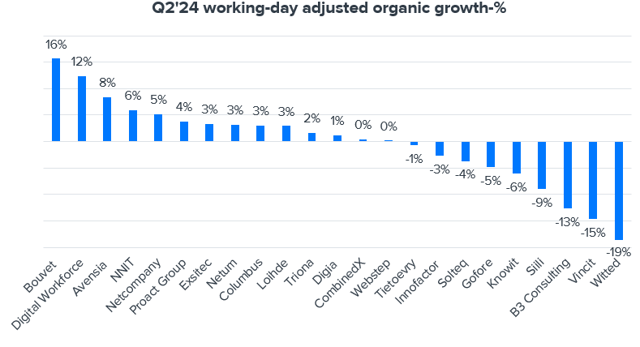

IT service sector: Market performance in Denmark and Norway better than in Finland and Sweden

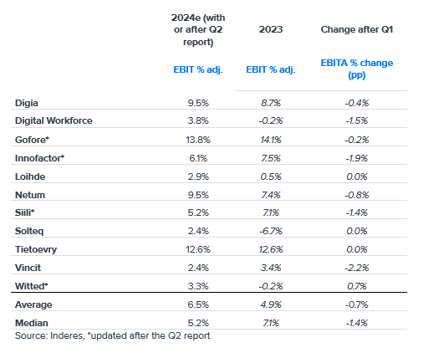

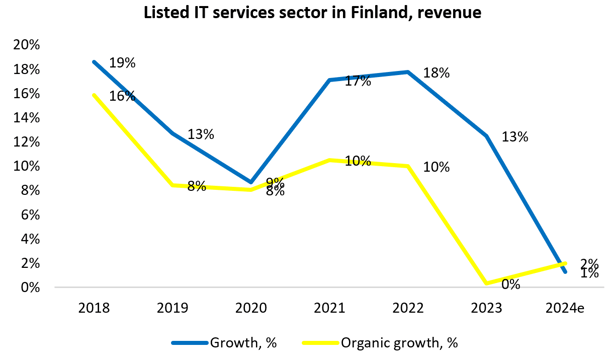

IT services sector 2024 expectations fell slightly in Q2, but H2 looks a little better

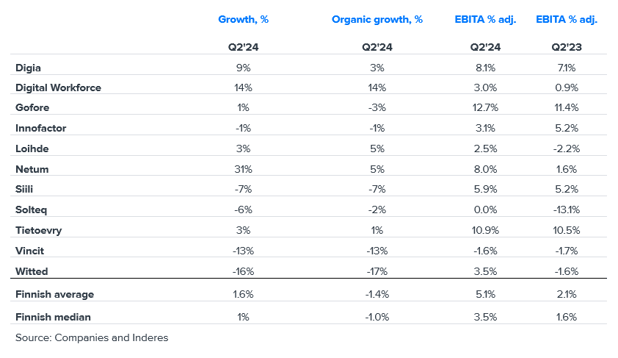

Q2 IT service sector summary: Slightly steeper revenue decline, improved profitability and signs of demand bottoming out

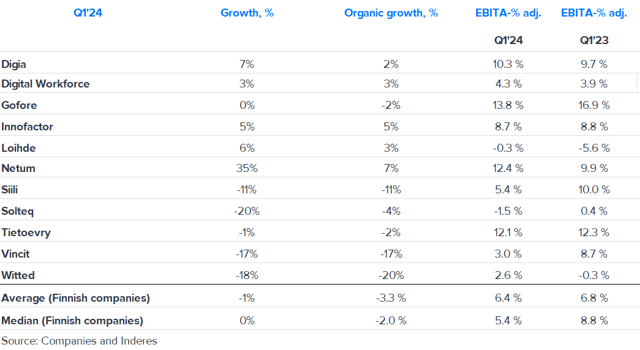

IT services sector's 2024 expectations fell slightly in Q1 - revenue expected to remain flat and profitability to rise slightly

IT service sector Q1 summary: Revenue and profitability down from a strong comparison period, but some defensive wins in profitability as well

IT service sector: Our expectations for 2024 generally at the lower end of companies' guidance

Q4 IT service sector summary: Growth and profitability in line with our expectations, 2023 can be seen as a defensive win

IT service sector valuation levels at the bottom of our 7-year monitoring history, justifiably?

We expect the IT services sector to grow moderately and profitability to increase slightly in 2024

IT services sector Q3 summary: Better than feared with several areas continuing to perform well

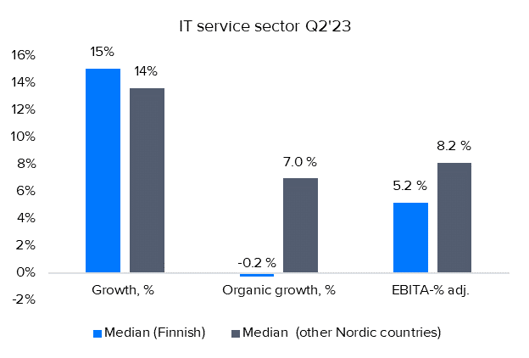

IT service sector: Fast deceleration in figures in Q2 in Finland, better in other Nordic countries

IT service sector: Mainly a strong start to the year

Case: Cost structures and profitability of expert companies