Siili Solutions

5.88

EUR

+0.68 %

7,812 following

SIILI

NASDAQ Helsinki

Software

Technology

Overview

Financials & Estimates

Investor consensus

+0.68%

-2.33%

+9.7%

+3.89%

-17.88%

-36.91%

-59.59%

-29.33%

+129.09%

Siili Solutions is a provider in the IT sector. The company develops and integrates software for information systems and offers services related to the development of technology platforms, information management, IT architecture, and various project management. The competence is found in data management, analysis, and artificial intelligence. Siili Solutions was founded in 2005 and is headquartered in Helsinki.

Read moreMarket cap

47.86M EUR

Turnover

6.26K EUR

P/E (adj.) (25e)

10.14

EV/EBIT (adj.) (25e)

7.39

EV/S (25e)

0.4

Dividend yield-% (25e)

3.4 %

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

22/4

2025

Business review Q1'25

12/8

2025

Interim report Q2'25

21/10

2025

Business review Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

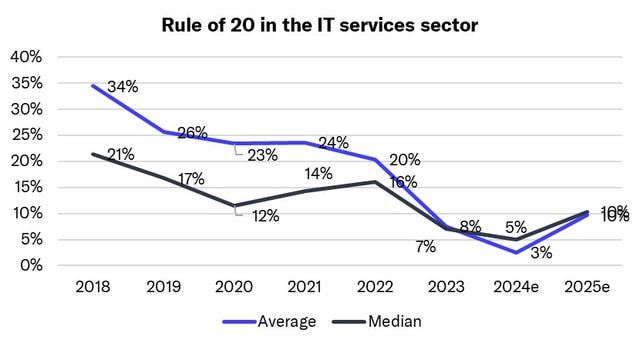

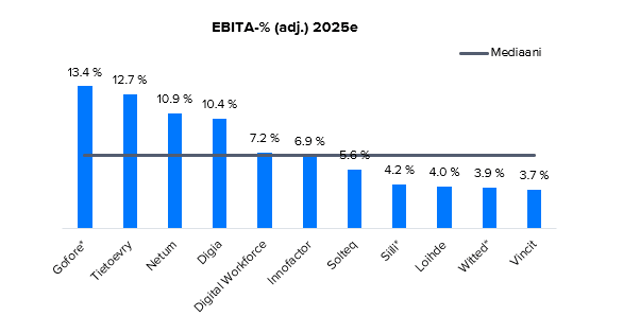

Outlook for the IT service sector 2025: Growth will kick off again at the end of the year

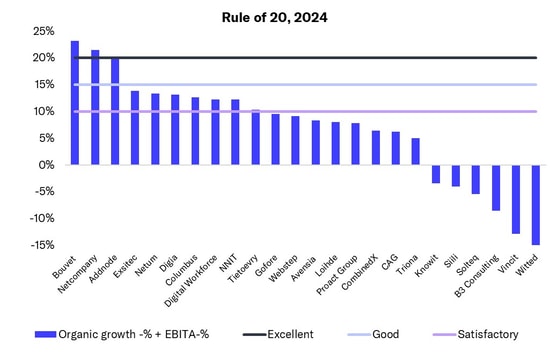

In the IT service sector, a few Nordic companies achieved excellent performance measured by the 'Rule of 20'

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

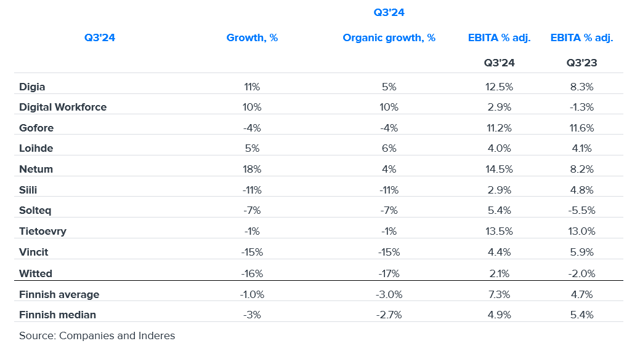

IT service sector: Q4 was tough, as was 2024

Siili Solutions Plc Annual Report 2024 has been published

Siili Solutions Plc - Managers' Transactions - Pienimäki

Siili Solutions Plc - Managers' Transactions - Pienimäki

The Board of Directors of Siili Solutions Plc established a matching share plan for key employees and resolved on a new performance period for the performance share plan

Notice convening the Annual General Meeting of Siili Solutions Plc

Siili Solutions Plc, Financial statements bulletin, 1 January–31 December 2024 (unaudited)

Introducing the Rule of 20: The best measure for IT services performance signals market softening

Proposals of the Shareholders’ Nomination Board of Siili Solutions Plc to the AGM 2025

Siili Solutions Plc resolved on a new plan period of the employee share savings plan and on a related stock option plan

IT service sector: Bottom of cycle passed, grain will be separated from chaff in 2025

Siili Solutions Plc - Managers' Transactions - Pienimäki

Siili Solutions Plc's Capital Markets Day 2024

Siili Solutions Plc updates its long-term financial targets for 2025-2028