Modulight

1.24

EUR

-2.97 %

2,724 following

MODU

First North Finland

Medical Equipment & Services

Health Care

Overview

Financials & Estimates

-2.97%

-6.77%

+20.39%

+29.17%

+16.98%

+29.17%

-79.67%

-

-88.67%

Modulight operates in the technology industry. The company designs, markets, and produces biomedical laser products used in oncology, genetics, and ophthalmology. The customers primarily consist of hospitals and corporate customers operating in medical technology. In addition to the main business, various value-added services are also offered. Their main market is the US.

Read moreMarket cap

52.85M EUR

Turnover

7.7K EUR

P/E (adj.) (25e)

-8.61

EV/EBIT (adj.) (25e)

-6.82

EV/S (25e)

6.14

Dividend yield-% (25e)

-

Coverage

Analyst

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

25/4

2025

Interim report Q1'25

2/5

2025

General meeting '25

22/8

2025

Interim report Q2'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Notice To Modulight Corporation's Annual General Meeting

Modulight’s Annual Report 2024 Published

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Modulight receives orders for quantum computing

Inside Information: Modulight has received purchase orders worth of 0.8 million dollars

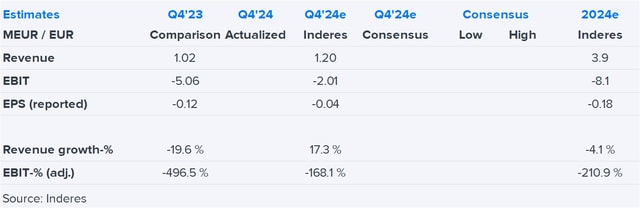

Modulight Q4'24: Indications of improving outlook

Proposals of the Shareholders’ Nomination Board of Modulight to the Annual General Meeting 2025

Modulight: Strong order intake and cost reductions improved cash flow despite increased R&D investments

Modulight Q4'24 preview: We don't expect any major surprises

Modulight to publish its financial statements bulletin for January–December 2024 on February 21, 2025

Modulight’s financial reporting and Annual General Meeting in 2025

Change in Modulight Corporation’s holding of treasury shares and annulment of option rights

Modulight receives order worth 0.5 MEUR

Drug development investment: Value creation through M&As and licensing agreements

Inside Information: Modulight Has Received an Order Worth EUR 0.5 Million

Modulight Corporation's Shareholders’ Nomination Committee Composition

Regulation of drug development