Nightingale Health

2.85

EUR

+1.79 %

4,595 following

HEALTH

NASDAQ Helsinki

Medical Equipment & Services

Health Care

Overview

Financials & Estimates

Investor consensus

+1.79%

-3.06%

+5.95%

-1.04%

-2.4%

+105.78%

+28.96%

-

-44.66%

Nightingale Health operates in medical technology. The company specializes in the development of medical devices. The product portfolio is broad and includes platforms and services in blood tests that are used for disease prevention purposes. In addition to the main business, service and associated ancillary services are also offered. The business is run globally with the largest presence in Europe.

Read moreMarket cap

173.65M EUR

Turnover

85.91K EUR

P/E (adj.) (25e)

-10.63

EV/EBIT (adj.) (25e)

-6.88

P/B (25e)

2.5

EV/S (25e)

22.9

Dividend yield-% (25e)

-

Coverage

Head of Nordic ER Development, Analyst

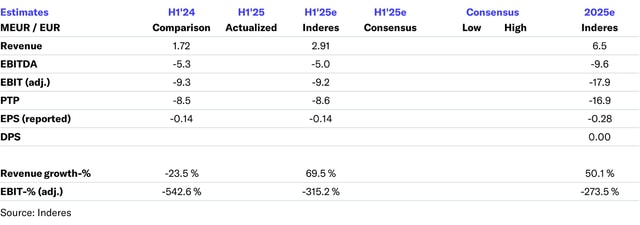

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Trading in Nightingale Health's B shares and ADRs begins on 21 March 2025 on the OTCQX International Market in the US

Nightingale Health Plc's listing application has been approved and trading in its Series B shares on the Main Market of Nasdaq Helsinki will commence on 19 March 2025

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Nightingale OTC trading in the US likely to start already within a week

The Finnish Financial Supervisory Authority has approved Nightingale Health Plc's Finnish prospectus

Nightingale Health establishes ADR program in the US - trading in Company's B shares and ADRs begins on 19 March 2025, at the earliest, and 24 March 2025, at the latest, on the OTCQX Market in the US

Nightingale applies for its shares to be listed on the Main Market of Nasdaq Helsinki

Nightingale Health Plc applies for its series B shares to be listed on the Main Market of Nasdaq Helsinki

Nightingale H1'FY25: Blood draws again

Nightingale, Webcast, Q2'25

Nightingale Health's half-year report: International expansion continues in Southeast Asia and the United States