Hexicon

0,24

SEK

+5,26 %

Under 1K följer bolaget

HEXI

First North Stockholm

Förnyelsebara energikällor

Energi

Översikt

Nyckeltal & Estimat

Ägarlista

Investerarkonsensus

+5,26%

+33,19%

+30,43%

+84,05%

+7,62%

−50,21%

−89,54%

-

−92,36%

Hexicon är en projektutvecklare inom flytande vind som öppnar upp nya marknader i länder med djupt vatten. Bolaget är också teknikleverantör med TwinWind, en patenterad flytande vinddesign. Tekniken möjliggör utökat nyttjande av global vindkraft och kan därmed bidra till ökad tillgång till förnyelsebar energi. Hexicon verkar på flera marknader i Europa, Afrika, Asien och Nordamerika.

Läs meraBörsvärde

87,31 mn SEK

Omsatt (värde)

69,44 tn SEK

P/E (just.) (25e)

1,83

EV/EBIT (adj.) (25e)

5,09

P/B (25e)

−0,37

EV/S (25e)

2,86

Direktavkastnings- % (25e)

-

Omsättning & EBIT-%

Omsättning mn

EBIT-%

Vinst per aktie & Utdelning

EPS (adj.)

Direktavkastning

Finansiell kalender

7/5

2025

Bolagsstämma '25

28/5

2025

Delårsrapport Q1'25

20/8

2025

Delårsrapport Q2'25

Risk

Business risk

Valuation risk

Låg

Hög

Alla

Analys

Webcasts

Pressmeddelanden

Tredje part

Hexicon AB (publ) publishes its annual report for 2024

Notice to attend the annual general meeting in Hexicon AB (publ)

Välkommen med i Inderes community!

Skapa ett gratis användarkonto och försäkra dig om att inte missa några börsnyheter av intresse för precis dig!

Inderes användarkonto

Ger dig möjlighet att följa bolag och beställa notifikationer

Tillgång till analytikerkommentarer och rekommendationer

Tillgång till vårt aktiescreeningsverktyg och andra populära verktyg

Kallelse till årsstämma i Hexicon AB (publ)

Hexicon: En efterlängtad avyttring, men finansieringsriskerna kvarstår

VD Intervju: Hexicon avyttrar två av sina italienska projekt

Hexicon (publ) avyttrar två av sina italienska projekt till Ingka Investments och Oxan Energy

Hexicon (publ) Divests two of its Italian Projects to Ingka Investments and Oxan Energy

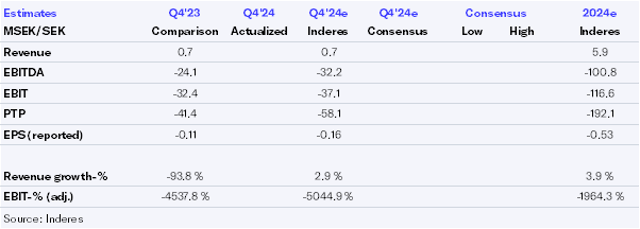

Hexicon Q4'24: Delays in divestments extend funding uncertainty

Hexicon Q4´24: Fokus i Sydkorea ligger på att etablera ny ägarstruktur

Hexicon, Webcast, Q4'24

Hexicon AB (publ) releases its interim report for Q4 2024

Hexicon AB (publ) publicerar sin delårsrapport för det fjärde kvartalet 2024

Hexicon Q4’24 preview: It’s all about divestments

Inbjudan till presentation av Hexicons bokslutskommuniké för 2024 den 19 februari

Invitation to the presentation of Hexicon’s year-end report for 2024 on the 19th of February

Hexicon extends its current credit facility

Hexicon förlänger kreditfacilitet

Hexicon extends credit facility