Lindex Group

2.895

EUR

-0.86 %

6,813 following

LINDEX

NASDAQ Helsinki

Personal Goods

Consumer Goods & Services

Overview

Financials & Estimates

Investor consensus

-0.86%

-6.61%

+8.22%

+7.62%

+1.05%

-11.47%

+64.68%

+292.81%

-80.67%

Lindex Group operates in the retail industry. The Group manages a number of stores around larger shopping centers and commercial premises located in the Nordic market. The Group is a reseller of several brands and the range consists of shoes and associated accessories. The company is headquartered in Helsinki.

Read moreMarket cap

468.22M EUR

Turnover

586.17K EUR

P/E (adj.) (24e)

21.14

EV/EBIT (adj.) (24e)

14.96

P/B (24e)

1.18

EV/S (24e)

1.11

Dividend yield-% (24e)

-

Coverage

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

29/4

2025

Interim report Q1'25

18/7

2025

Interim report Q2'25

24/10

2025

Interim report Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Lindex Group, Webcast, Q1'25

Lindex Group Oyj: The Board of Directors of Lindex Group plc has resolved on a directed share issue without consideration for the delivery of the long-term incentive scheme rewards

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Lindex Group Oyj: Styrelsen för Lindex Group Abp har beslutat om en riktad aktieemission för betalning av belöningarna i det långsiktiga incitamentsprogrammet

Lindex Group Oyj: Decisions by Lindex Group plc's Annual General Meeting and the organizational meeting of the Board of Directors

Lindex Group Oyj: Beslut vid Lindex Group Abp:s ordinarie bolagsstämma och styrelsens konstituerande möte

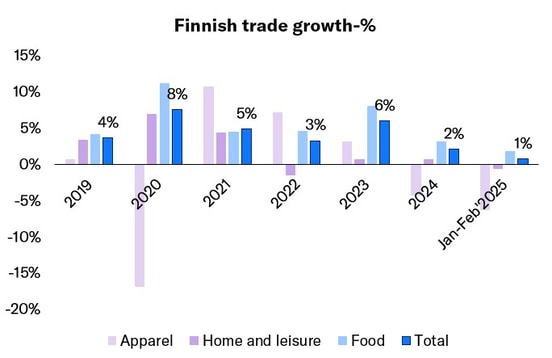

Finnish trade down in February

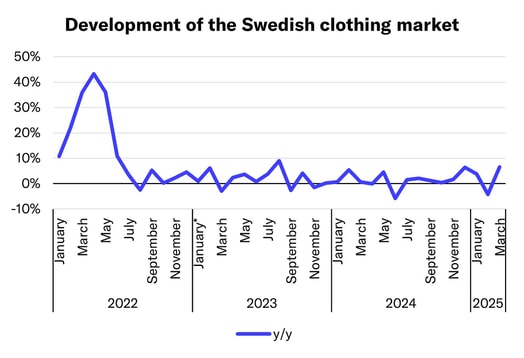

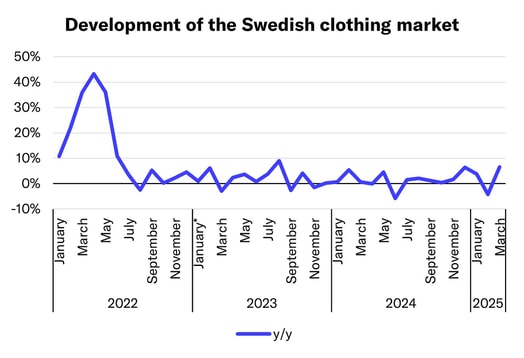

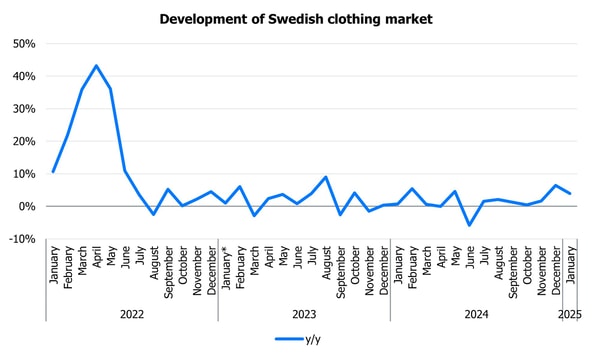

Lindex Group: The Swedish clothing market decreased in February

Lindex Group Oyj: Lindex Group's Annual Report and Remuneration Report for 2024 have been published

Lindex Group Oyj: Lindexkoncernens årsrapport och ersättningsrapport för år 2024 har publicerats

Lindex Group Oyj: Share-based long-term incentive scheme for the key management of Lindex Group and its divisions

Lindex Group Oyj: Ett aktiebaserat långsiktigt incitamentsprogram för ledningen i Lindexkoncernen samt dess divisioner

Lindex Group Oyj: Notice to Lindex Group plc's Annual General Meeting

Lindex Group Oyj: Kallelse till Lindex Group Abp:s ordinarie bolagsstämma

Growth trend in Finnish trade in January followed last year's pattern

Lindex Group: Swedish clothing market continued to grow in January

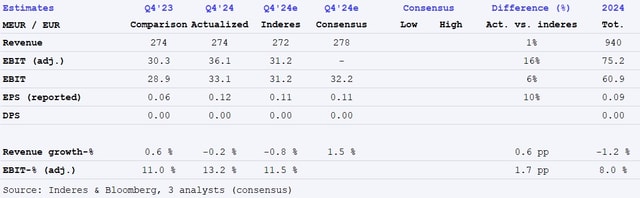

Lindex Q4’24: Still waiting for results from strategic review

Lindex Q4'24: Strong end to the year and positive outlook

Lindex Group Q4´24: Resultatet klart starkare än vi förväntat oss