Solwers

2,25

EUR

+2,27 %

SOLWERS

First North Finland

Industriella Varor & Tjänster

Industri

Solwers är ett konsultbolag inriktade mot den industriella sektorn. Bolaget är specialiserat inom digitala lösningar som berör planerings- och projektledningstjänster. Exempel på bolagets tjänster inkluderar arkitektur, teknisk konsultation, miljöövervakning, projektledning, cirkulär ekonomi samt digitala lösningar. Kunderna finns inom ett flertal branscher, huvudsakligen bland små- och medelstora företagskunder. Verksamhet återfinns runtom den globala marknaden, med störst närvaro inom Norden.

Läs meraCoverage

Co. Head of Research

Omsättning & EBIT-%

Omsättning mn

EBIT-%

Vinst per aktie & Utdelning

EPS (adj.)

Direktavkastning

Finansiell kalender

Business review Q1'25

Delårsrapport Q2'25

Business review Q3'25

Risk

Solwers Oyj: Notice convening the Annual General Meeting of Solwers Plc

Solwers Oyj: Solwers Plc's Financial Reports and Remuneration Report for the Year 2024 Published

Välkommen med i Inderes community!

Skapa ett gratis användarkonto och försäkra dig om att inte missa några börsnyheter av intresse för precis dig!

Inderes användarkonto

Solwers' CEO will change by next spring

Solwers Oyj: Inside information: Solwers' CEO to change by spring 2026

Solwers Oyj: Proposals of Solwers Plc's Shareholders' Nomination Committee for the Annual General Meeting 2025

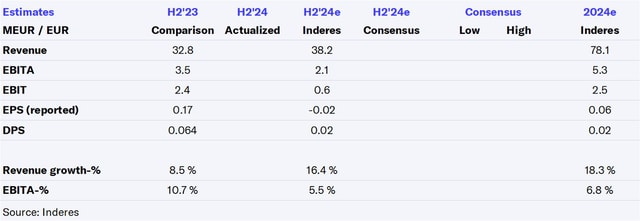

Solwers H2'24: Increased investment activity is key

Solwers H2’24: “Jag ser positivt på framtiden”

Solwers, Webcast, Q4'24

Solwers Oyj: Financial Statements Release 1 January - 31 December, 2024

Solwers Q4'24 preview: With the profit warning, the overall picture of the result is clear

Kreate has filed a compensation claim against Solwers' subsidiary

Solwers Oyj: Inside Information: Solwers Plc's subsidiary Finnmap Infra Oy has received a compensation claim filed by Kreate Oy

Solwers Oyj: Publication of Solwers' Financial Statements 2024 Release and invitation to webcast

Solwers: Challenges have surfaced late in the year

Solwers Oyj: Inside Information: Solwers' IFRS EBIT at the end of 2024 lower than anticipated

Solwers Oyj: Solwers Plc's Financial Calendar and Annual General Meeting 2025

Solwers as an Investment | Company Night Dec. 16, 2024