Taaleri

7.28

EUR

+0.97 %

8,884 following

TAALA

NASDAQ Helsinki

Financial Services

Financials

Overview

Financials & Estimates

Investor consensus

+0.97%

-5.82%

-8.31%

-9.34%

-10.46%

-29.46%

-36.59%

+15.56%

+142.67%

Taaleri operates in the financial sector. The company is a Nordic private equity fund company that focuses on renewable energy and other alternative investments. The company has two business segments: Equity Funds and Strategic Investments. With its capital funds, Taaleri creates, for example, wind and solar power, biofuels and real estate. The company was founded in 2007 and its head office is located in Helsinki, Finland.

Read moreMarket cap

205.27M EUR

Turnover

147.52K EUR

P/E (adj.) (25e)

10.56

EV/EBIT (adj.) (25e)

6.01

P/B (25e)

0.96

EV/S (25e)

2.75

Dividend yield-% (25e)

5.68 %

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

29/4

2025

Interim report Q1'25

13/8

2025

Interim report Q2'25

2/10

2025

Half year dividend

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

3rd party

ShowingAll content types

Garantia guaranteed Multi-Issuer Bond series continues with fifth issue, sized at EUR 62.5 million

Taaleri changes its financial reporting and publishes comparable income statement, balance sheet and segment information for 2024

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Taaleri establishes a new share-based incentive plan for the CEO

Decisions of the organisational meeting of Taaleri Plc’s Board of Directors

Decisions of Taaleri Plc's Annual General Meeting 2025

Taaleri Interim Statement for the period January–March 2025

Taaleri Plc’s Annual Report 2024 has been published

Impact of real estate fund issues on various Finnish asset managers

Notice to the Annual General Meeting of Taaleri Plc

Taaleri Plc – Managers’ transactions – Leif Frilund

Taaleri Plc – Managers’ transactions – Titta Elomaa

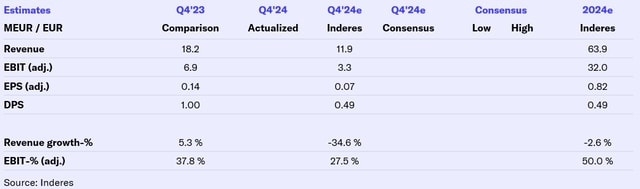

Taaleri Q4'24: Share remains firmly in the discount basket

Taaleri Q4'24 flash comment: Big earnings beat on non-recurring fees and outlook is clear

Taaleri Financial Statements Bulletin 2024

Changes in Taaleri’s management – Lauri Lipsanen appointed as CFO and member of the Executive Management Team

Taaleri Plc Interim Statement 1.1.–31.12.2024: Taaleri’s positive financial performance continued in the final quarter of the year