Penneo

Less than 1K followers

Overview

Investor consensus

Penneo is a Danish Software-as-a-Service (SaaS) company delivering solutions for digital signing (Penneo Sign), document workflow, and compliance such as a Know Your Customer product (Penneo KYC) that helps companies comply with Anti Money Laundering (AML) legislation. Penneo was established in Denmark in 2014, and the company has more than 3,000 customers across Denmark, Sweden, Norway, Finland, and Belgium. Penneo is listed on Nasdaq Copenhagen Main Market.

Read moreLatest research

Latest analysis report

Released: 2024-08-30

All

Research

Webcasts

Press releases

3rd party

ShowingAll content types

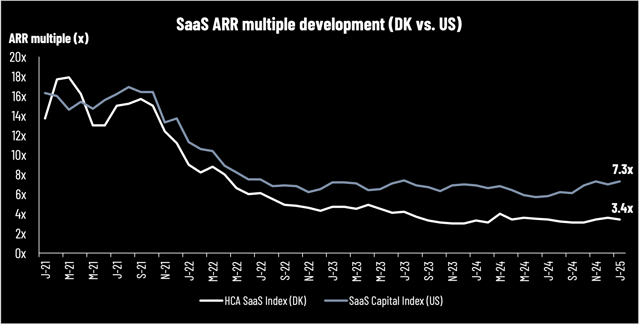

HCA SaaS update January 2025: DeepSeek – a Cisco moment for investors

Penneo: Major Shareholder Announcement

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools