Kreate Group

7.88

EUR

0 %

3,089 following

KREATE

NASDAQ Helsinki

Construction & Materials

Industrials

Overview

Financials & Estimates

Investor consensus

0%

-3.19%

+7.65%

+10.36%

-8.16%

+2.34%

-15.72%

-

-26.29%

Kreate Group is active in the infrastructure sector. The company offers a wide range of services in the development of demanding industrial projects. Examples of services include repair and construction of bridges, track construction for trains and rails, as well as mass excavation and crushing of stone for extensions of new motorways. The largest business operations are in the Nordic market.

Read moreMarket cap

70.8M EUR

Turnover

6.05K EUR

P/E (adj.) (25e)

12.52

EV/EBIT (adj.) (25e)

9.71

P/B (25e)

1.58

EV/S (25e)

0.34

Dividend yield-% (25e)

6.47 %

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

24/4

2025

Interim report Q1'25

15/7

2025

Interim report Q2'25

24/9

2025

Half year dividend

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Kreate Group’s Annual Review for 2024 has been published

Notice to the Annual General Meeting of Kreate Group Plc

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Kreate has filed a compensation claim against Solwers' subsidiary

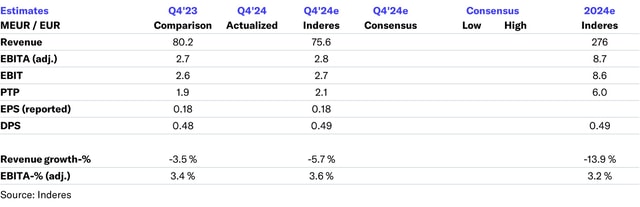

Kreate Q4'24: Back to growth

Kreate, Webcast, Q4'24