Scanfil

8.78

EUR

-3.09 %

5,385 following

SCANFL

NASDAQ Helsinki

Software

Technology

Overview

Financials & Estimates

Investor consensus

-3.09%

-4.98%

+4.52%

+6.42%

+11.56%

+17.85%

+33.03%

+90.46%

+1,040.26%

Scanfil is an international electronics contract manufacturer specializing in industrial and B2B customers. Its service offering includes manufacturing of end-products and components such as PCBs. Manufacturing services are the core of the company supported by design, supply chain, and modernization services. It operates globally in Europe, the Americas, and Asia. Customers are mainly companies operating in process automation, energy efficiency, green transition, and medical segments.

Read moreMarket cap

573.77M EUR

Turnover

100.06K EUR

P/E (adj.) (25e)

12.77

EV/EBIT (adj.) (25e)

9.59

P/B (25e)

1.8

EV/S (25e)

0.69

Dividend yield-% (25e)

2.85 %

Coverage

Head of Research

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

17/7

2025

Interim report Q2'25

24/10

2025

Interim report Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

3rd party

ShowingAll content types

Scanfil Q1'25: Share price has reached neutral zone

Carnegie Access: Scanfil: Order activity remains solid, miss on earnings – Q1 review

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Scanfil Q1'25 flash comment: Successfully avoiding the worst pitfalls in a broken quarter

Carnegie Access: Scanfil: Solid order intake, miss on earnings – Q1 initial comment

Scanfil plc: Quarter unfold as expected confirming positive view on the year

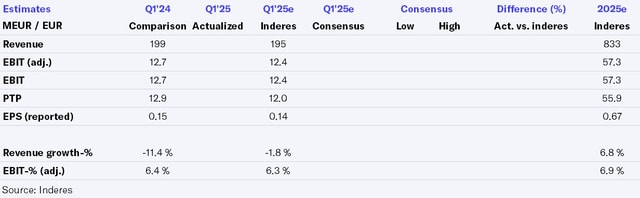

Scanfil Q1'25 earnings preview: Ramp-up of project wins to burden figures in the first months of the year

Scanfil’s CEO’s Review Will Be Held Prior to the Annual General Meeting 2025

Scanfil’s January-March Interim Report Release on 24 April 2025