Remedy Entertainment

17.82

EUR

+3.01 %

11,333 following

REMEDY

NASDAQ Helsinki

Software

Technology

Overview

Financials & Estimates

Investor consensus

+3.01%

+32%

+36.03%

+26.74%

+19.12%

-11.34%

-42.33%

-9.77%

+166.37%

Remedy Entertainment is a game developer. The business is primarily focused on the development of action games, with a particular focus on 3D technology. Examples of games developed by the company include several different versions of Alan Wake, Max Payne, and Control. Remedy also develops its own game engine and utility technology that powers many of the games. The company was founded in 1995 and has its headquarters in Espoo.

Read moreMarket cap

242.12M EUR

Turnover

339.4K EUR

P/E (adj.) (25e)

43.31

EV/EBIT (adj.) (25e)

27.75

P/B (25e)

3.12

EV/S (25e)

3.14

Dividend yield-% (25e)

-

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

12/8

2025

Interim report Q2'25

29/10

2025

Business review Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Remedy Offers to Purchase 2019 Options from Key Personnel

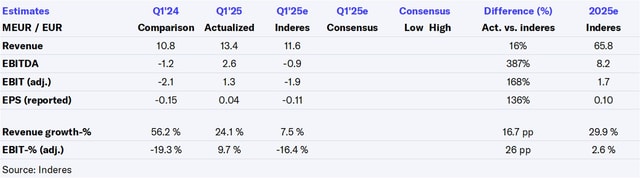

Remedy Q1'25 flash comment: Good start to the year ahead of FBC: Firebreak release

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Remedy Entertainment, Webcast, Q1'25

Remedy Entertainment Plc: Business Review January–March 2025: Remedy’s first self-published game to be released in June 2025

Remedy Entertainment Plc: Share subscriptions based on stock options 2019

Remedy's FBC: Firebreak will be released on June 17

Remedy Entertainment Plc: FBC: Firebreak to Launch Worldwide on June 17

Remedy Q1'25 preview: In anticipation of FBC: Firebreak release

Resolutions of Remedy Entertainment Plc’s Annual General Meeting and the organizing meeting of the Board of Directors

New trailer released for Remedy's FBC: Firebreak coming this summer

Remedy Entertainment Plc: FBC: Firebreak coming in Summer 2025

Remedy Entertainment Plc: Notice to the Annual General Meeting of Remedy Entertainment Plc

Remedy Entertainment Plc: Remedy’s Annual Report 2024, Financial Statement, Remuneration Report and Corporate Governance Statement have been published

Remedy Q4'24: FBC: Firebreak release draws nearer

Remedy Entertainment Plc: Managers' Transactions – Kai Tavakka

Remedy Entertainment Plc: Financial Statements Release January-December 2024: Alan Wake 2 sales exceeded 2 million units and the game started to accrue royalties, updated company strategy and growth objectives announced