Purmo Group

1,526 following

All

Research

Webcasts

Press releases

ShowingAll content types

Trading in Purmo stock suspended and our coverage ends

The arbitral tribunal has confirmed Project Grand Bidco (UK) Limited's redemption right over the minority shares in Purmo Group Plc, and trading in the Purmo Group shares has been suspended

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Change in Purmo Group Plc’s financial reporting in 2025

Jörn Neubert appointed Chief Operating Officer of Purmo Group Plc

Purmo Group reached the Excellence class in the ESG Transparency Award evaluation

Purmo Group Plc applies for the delisting of its shares from the official list of Nasdaq Helsinki

Arbitral tribunal appointed for the arbitration proceedings concerning the redemption of minority shares in Purmo Group Plc

Purmo Group Plc – Managers' transactions – Rettig Oy Ab

Purmo Q3'24: Already on the way out of the stock market

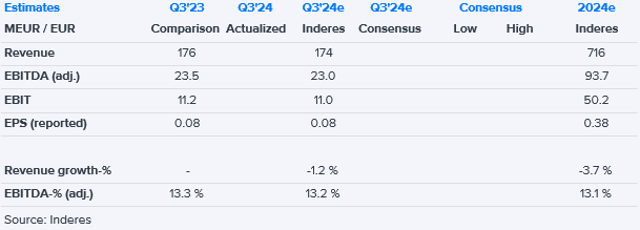

Purmo Q3'24 flash comment: Profitability missed comparison period and our estimates

Purmo Group’s interim report January-September 2024: Pick-up in demand in many sales regions during the quarter, adjusted EBITDA margin remained solid during the review period