Hexicon

0.235

SEK

-2.08 %

Less than 1K followers

HEXI

First North Stockholm

Renewable

Energy

Overview

Financials & Estimates

Ownership

Investor consensus

-2.08%

+30.41%

+30.41%

+80.21%

+2.84%

-51.04%

-89.76%

-

-92.51%

Hexicon is a project developer in floating wind that opens up new markets in countries with deep water. The company is also a technology supplier with TwinWind, a patented floating wind design. The technology enables increased use of global wind power and can thus contribute to increased access to renewable energy. Hexicon operates in several markets in Europe, Africa, Asia and North America.

Read moreMarket cap

85.49M SEK

Turnover

49.75K SEK

P/E (adj.) (25e)

1.79

EV/EBIT (adj.) (25e)

5.08

P/B (25e)

-0.36

EV/S (25e)

2.85

Dividend yield-% (25e)

-

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

7/5

2025

General meeting '25

28/5

2025

Interim report Q1'25

20/8

2025

Interim report Q2'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

3rd party

ShowingAll content types

Hexicon AB (publ) publishes its annual report for 2024

Notice to attend the annual general meeting in Hexicon AB (publ)

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Kallelse till årsstämma i Hexicon AB (publ)

Hexicon: A long-awaited divestment, but financing risks persist

VD Intervju: Hexicon avyttrar två av sina italienska projekt

Hexicon (publ) avyttrar två av sina italienska projekt till Ingka Investments och Oxan Energy

Hexicon (publ) Divests two of its Italian Projects to Ingka Investments and Oxan Energy

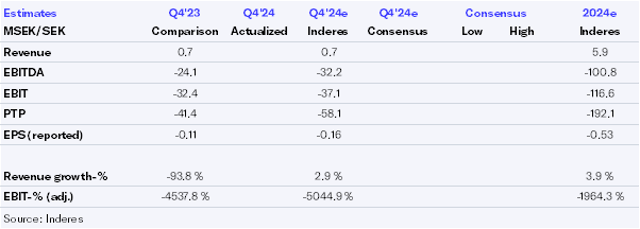

Hexicon Q4'24: Delays in divestments extend funding uncertainty

Hexicon Q4´24: Fokus i Sydkorea ligger på att etablera ny ägarstruktur

Hexicon, Webcast, Q4'24

Hexicon AB (publ) releases its interim report for Q4 2024

Hexicon AB (publ) publicerar sin delårsrapport för det fjärde kvartalet 2024

Hexicon Q4’24 preview: It’s all about divestments

Inbjudan till presentation av Hexicons bokslutskommuniké för 2024 den 19 februari

Invitation to the presentation of Hexicon’s year-end report for 2024 on the 19th of February

Hexicon extends its current credit facility

Hexicon förlänger kreditfacilitet

Hexicon extends credit facility