Hexagon

88.6

SEK

-1.53 %

Less than 1K followers

HEXA B

NASDAQ Stockholm

Hardware Manufacturer

Technology

Overview

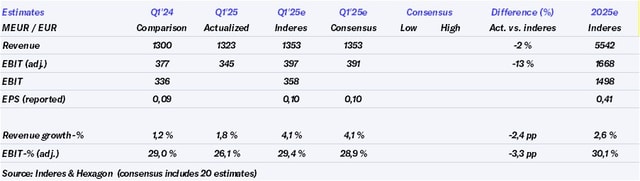

Financials & Estimates

Ownership

Investor consensus

-1.53%

-23.85%

-20.18%

-16.1%

-13.39%

-27.44%

-33.13%

+40.7%

+16,447.14%

Hexagon is a global provider of technology solutions. The company specializes in the development of information technology that is further used in geospatial and industrial applications. The company's solutions mainly integrate sensors, software, industrial knowledge, and customers' workflows into information ecosystems. Customers are found on a global level in various industries. Hexagon was founded in 1975 and is headquartered in Stockholm, Sweden.

Read moreMarket cap

239.71B SEK

Turnover

155.5M SEK

P/E (adj.) (25e)

18.59

EV/EBIT (adj.) (25e)

15.32

EV/S (25e)

4.42

Dividend yield-% (25e)

1.87 %

Revenue and EBIT-%

Revenue B

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

30/4

2025

Interim report Q1'25

5/5

2025

General meeting '25

6/5

2025

Annual dividend

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

Hexagon to acquire CONET Communications assets to strengthen public safety capabilities

Finansinspektionen: Flaggningsmeddelande i Hexagon Aktiebolag

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Hexagon: Fear is a friend to the long-term-oriented investor

Hexagon: Tariffs have burdened sensor sales already in March

Hexagon offentliggör en uppdatering av utvecklingen under det första kvartalet 2025

Hexagon announces an update on performance in the first quarter of 2025