Componenta

4.19

EUR

-2.56 %

4,058 following

CTH1V

NASDAQ Helsinki

Industrial Goods & Services

Industrials

Overview

Financials & Estimates

Investor consensus

-2.56%

+11.73%

+51.26%

+51.81%

+29.72%

+67.6%

+36.93%

+31.85%

-96.48%

Componenta is a manufacturing company. The company is a supplier of casting solutions that are also used in a number of industrial vehicles, mainly trucks and larger machines. In addition to the main business, associated engineering services are offered. Componenta operates worldwide with the largest presence around the European market. The head office is located in Vantaa.

Read moreMarket cap

40.73M EUR

Turnover

92.87K EUR

P/E (adj.) (25e)

45.67

EV/EBIT (adj.) (25e)

19.03

P/B (25e)

1.52

EV/S (25e)

0.41

Dividend yield-% (25e)

0.95 %

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

23/4

2025

General meeting '25

9/5

2025

Business review Q1'25

23/7

2025

Interim report Q2'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

Inside information: Componenta agreed on two financing arrangements with Avida

Number of Shares in Componenta Corporation has Increased through Subscription with Stock Options

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Componenta’s Annual Review and the Remuneration Report for 2024 published

Notice of the Annual General Meeting of Componenta Corporation

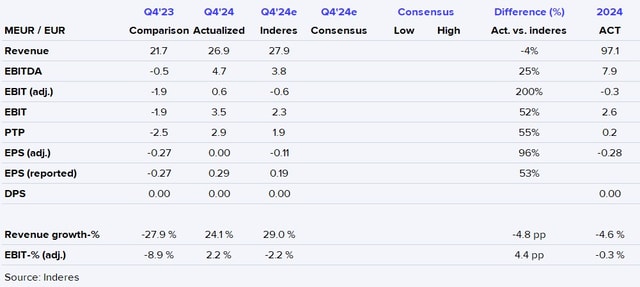

Componenta Q4'24: Missing clearer signs of a turnaround

Componenta Q4'24 flash comment: Sluggish volumes less of a drag than expected

Componenta’s Financial Statements Release 1 January–31 December 2024: Net sales and EBITDA improved in the last quarter of the year

Componenta Q4'24 preview: Price increase provides opportunity to sell

Componenta Corporation: Proposals of the Shareholders’ Nomination Board to the Annual General Meeting

Componenta Corporation: Managers’ Transactions – Harri Suutari

Componenta Corporation: Managers’ Transactions – Harri Suutari

The use of the previously agreed 9 million euros option of Finnish Defence Forces was confirmed

Componenta: Unfortunate, but not very surprising

Inside information, profit warning: Componenta lowers its guidance for net sales and EBITDA for 2024

Inside information: Componenta records a non-recurring income of approximately EUR 2.9 million from the purchase of the Kalajoki plant and the Sepänkylä Machining and Service Centre for the current year's other operating income

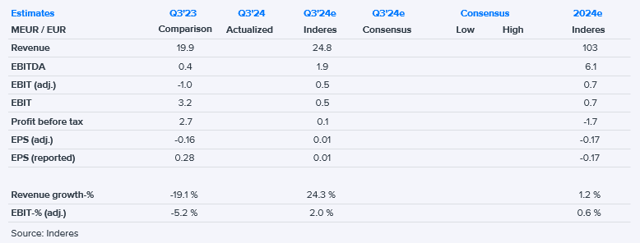

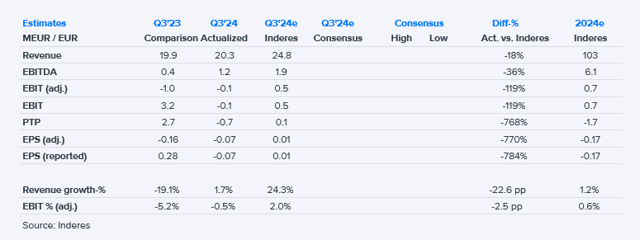

Componenta Q3'24: Stumbling but getting up again

Componenta Q3'24 flash comment: Missing volumes

Componenta Corporation’s business review 1 January–30 September 2024: Net sales and EBITDA decreased despite positive developments in Q2 and Q3