Canatu

9.98

EUR

+0.2 %

1,707 following

CANATU

First North Finland

Hardware Manufacturer

Technology

Overview

Financials & Estimates

Investor consensus

+0.2%

-18.2%

-14.7%

-15.42%

-18.2%

-2.16%

-11.29%

-

-5.1%

Canatu is a technology company active in deep technology that creates carbon nanotubes (Canatu CNT), related products and manufacturing equipment for the semiconductor, automotive and medical diagnostics industries. The company operates through two business models, firstly using their own reactors to develop and manufacture CNT products. Second, the company sells its CNT reactors and licenses its related technology, allowing customers to produce the products themselves under a limited license.

Read moreMarket cap

346.61M EUR

Turnover

93.44K EUR

P/E (adj.) (25e)

-91.39

EV/EBIT (adj.) (25e)

-34.58

EV/S (25e)

11.33

Dividend yield-% (25e)

-

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

15/5

2025

General meeting '25

29/8

2025

Interim report Q2'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

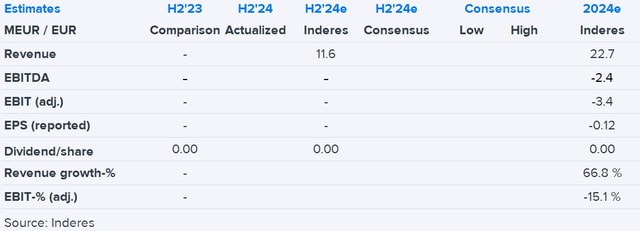

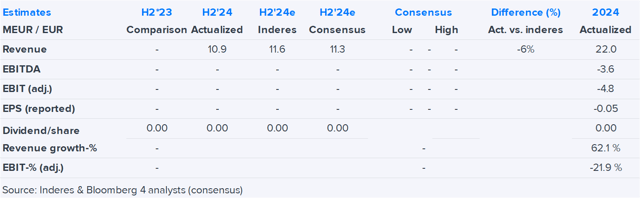

Canatu H2'24: Vague 2025 growth outlook can offer buying opportunities

Canatu, Webcast, Q4'24

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Canatu 2024 flash comment: Growth outlook for this year remains unclear

Canatu to expand with new production facility in Finland, doubling its premises

Canatu’s Financial Statement Bulletin 2024

Canatu appoints Tapani Salminen as the Chief Operations Officer; Mikko Vesterinen’s interim CFO role transitioning to permanent CFO

Canatu’s new Carbon Age program receives 10 MEUR funding from Business Finland

Inside information: Canatu launches Carbon Age program for which it has received EUR 10 million funding granted by Business Finland