Aiforia Technologies

3.62

EUR

+0.56 %

1,890 following

AIFORIA

First North Finland

Medical Equipment & Services

Health Care

Overview

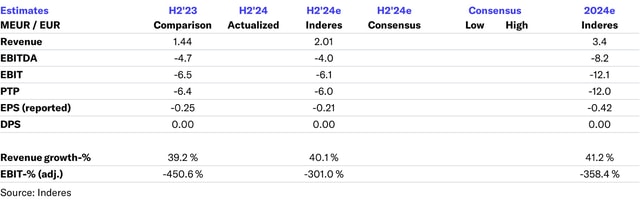

Financials & Estimates

Investor consensus

+0.56%

+3.43%

+3.13%

+3.13%

-5.97%

-4.23%

-22.98%

-

-28.46%

Aiforia Technologies equips pathologists and researchers in preclinical and clinical laboratories with software to translate images into discoveries, decisions and diagnoses. The company's products and services are used for medical image analysis, across a variety of areas from oncology to neuroscience. Aiforia Technologies is headquartered in Finland.

Read moreMarket cap

104.74M EUR

Turnover

37.92K EUR

P/E (adj.) (25e)

-10.12

EV/EBIT (adj.) (25e)

-9.5

P/B (25e)

6.24

EV/S (25e)

24.01

Dividend yield-% (25e)

-

Coverage

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

4/4

2025

General meeting '25

28/8

2025

Interim report Q2'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Aiforia and USCAP extend collaboration to support eLearning for pathologists

Aiforia's image recognition models also available on the PathPresenter platform

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools

Aiforia’s partnership with Techcyte offers an alternative to the structure of the market’s future value chain

Aiforia partners with PathPresenter to accelerate the adoption of digital pathology and AI

Aiforia and Techcyte announce strategic collaboration to advance AI-powered digital pathology

Aiforia’s partner network expands to Canada

Aiforia expands its global reach through a partnership with Quorum Technologies in Canada

Aiforia Technologies Plc Publishes its Board of Directors’ Report and Financial Statements for 2024

Notice of Aiforia Technologies Plc’s Annual General Meeting 2025

Aiforia Technologies Plc – Managers’ Transactions – Jukka Tapaninen

Aiforia H2'24: The fruits of customer wins are ripening

Aiforia Technologies Plc – Managers’ Transactions – Jukka Tapaninen

Aiforia, Webcast, Q4'24

Aiforia Technologies Plc’s Financial Statements Bulletin for January–December 2024: Aiforia’s market position and orderbook strengthened

Aiforia selected as partner for Sardinia’s regional health authority

Aiforia closes a deal with a regional health authority of Sardinia in Italy